Inheritance Cases in Cyprus: Subtleties and Assistance in Resolution

As Benjamin Franklin said, "Only taxes and death are inevitable." Therefore, the issue of inheritance arises in every family sooner or later. To comprehend your inheritance rights, it is essential to have an understanding of the country's legal system. Inheritance rights are clearly defined in the legislation of Cyprus, and this section is quite extensive and challenging for a layperson to grasp. Hence, individuals faced with the need to divide an inheritance often seek the assistance of an inheritance lawyer.

Inheriting the property (domiciled) of a deceased person (a citizen of Cyprus) is possible under two scenarios:

- By will

- According to the law (if a will was not drawn up during life).

It is important to note that the legislation of Cyprus governs the transfer of property located in the country (marked with domicile). If the deceased Cypriot had property abroad, this property is divided based on the legislation of the country in whose territory it is located.

Inheritance without a Will: Order of Rights

If the deceased person did not make a will, the property passes to the heirs based on legal norms. According to the law of Cyprus, when starting to consider inheritance cases, there are four categories of heirs:

- First Category: Includes the children of the deceased.

- Second Category: This group contains the parents of the deceased, as well as siblings.

- Third Category: This group includes the closest ancestors by blood, i.e., grandparents.

- Fourth Category: Cousins, brothers, sisters, and brothers of grandparents are gathered here.

If there is no will, the right to property ownership is transferred according to this scheme, starting with the heirs of the first category and so on.

Subtleties of Cyprus Legislation Regarding Inheritance Rights

It is important to note that, according to Cyprus law, even if a will has been drawn up, part of the inheritance passes to the legal heirs (which are the legal spouse, children, and other close relatives) as part of the “compulsory share.” When considering inheritance cases, the "compulsory share" is a legal term meaning that the legal heirs are entitled to a portion of the inheritance, even if they were not specified in the will.

Thus, if the marriage was officially concluded, then the spouse receives part of the inheritance in any case, even if he is not a citizen of Cyprus.

Another important detail concerns encumbered inheritance. In this case, the heir inherits all onerous burdens along with the property. For example, when inheriting a home purchased on credit, the heir is obliged to repay the loan taken.

Note that there is only one case in which the heir will not be able to inherit the property. This happens if the testator does not have a Title Deed in his name. This means that even if there is real estate registered with the Cyprus Land Committee in the name of the testator, but in the absence of a Title Deed, any manipulation of the real estate is prohibited.

As for the execution of wills for property located in Cyprus, it is possible to draw them up in any country in the world. The main criterion in this case is the drawing up of a will in accordance with Cypriot requirements. If you are making a will abroad, please ensure that it is drawn up and executed correctly and in accordance with Cypriot law. However, inheritance lawyers advise making wills in the country to avoid bureaucratic delays and formalities.

Inheritance and Taxation

Regarding inheritance taxation, the procedure is quite transparent, but there are some nuances. Therefore, it is advised to contact a probate lawyer for advice. Basically, any inherited property, including real estate, is not subject to taxes on the island. This amendment to the legislation was made back in 2000. However, if the heir is not domiciled in the country, this right does not apply, and his inheritance will be subject to tax.

To obtain domicile in Cyprus, there are two options:

- To be born on the island.

- Permanently reside in the country.

Therefore, if a foreign heir does not have domicile, he must prove his permanent presence on the island and his desire to obtain domicile in Cyprus. However, we note that it is not necessary to change citizenship. Foreign citizens can obtain domicile without changing citizenship.

Assistance in Preparing Wills and Support of Inheritance Cases

To avoid problems and misunderstandings and not to lose a legitimate inheritance due to an incorrect interpretation of the law, it is recommended to seek the services of a certified inheritance lawyer. A licensed lawyer knows all the intricacies of Cypriot legislation, promptly receives information about changes and amendments to this section of the law, and helps clients achieve legal inheritance.

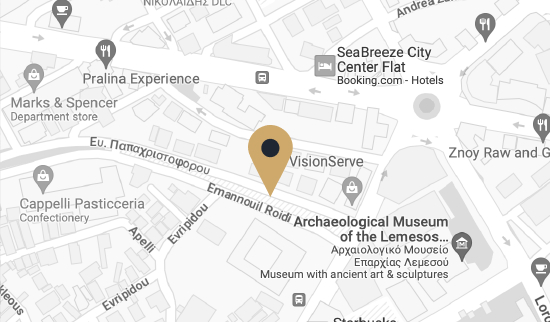

Our agency offers assistance from experienced, qualified lawyers in inheritance matters. Our team has an impeccable reputation based on resolving dozens of cases in this area. Our specialists provide assistance in drawing up legally correct wills, managing real estate, and protecting property rights. Our company includes a team of licensed professionals who advise clients on the preparation of wills, the transfer of ownership of real estate within the framework of inheritance law, and the legal registration of inheritance. We provide the following services:

- Drawing up a correct will from a legal point of view.

- Drawing up wills in accordance with the requirements of Cyprus legislation.

- Registration of the will in the court registry.

- Management by agreement.

- Management of foreign real estate.

- Asset protection.

Inheritance matters are an important section of legislation. The issue of heredity is relevant in every family because... no one can escape demise, and we all eventually come to the same end. Making a will is the easiest and most effective way to ensure that your property and funds are distributed to your relatives in accordance with your wishes. Qualified lawyers will help you draw up a legally correct will and be sure of its legality.